ACAIR app for iPhone and iPad

Developer: PRO-WARE, LLC

First release : 10 Sep 2015

App size: 6.75 Mb

The Affordable Care Act (ACA) created new reporting requirements based on health care provided to employees in 2015. The purpose of these new IRS tax forms is to inform the Internal Revenue Service (IRS) of the health care coverage that you offered to your employees.

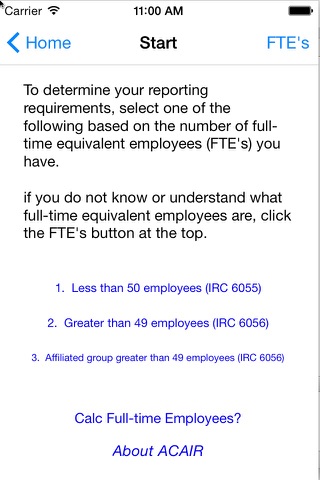

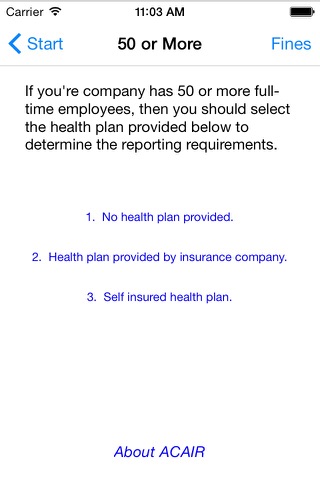

The information contained in this app will help you determine whether you need to file the information returns mandated by the Affordable Care Act under IRS Code Sections 6055 and 6056 or if you can rely on your health care provider to take care of this for you.

After viewing this app, you will be able to:

1. Determine what code section, if any, applies to your company.

2. What IRS tax return forms you need to file.

3. The penalties you are subject to if you fail to file the required returns.

4. The due date that the tax return forms must be filed with the IRS.

5. If a copy of these tax forms need to be provided to your employees.

6. The due date that the employee copies of the tax forms must be provided to them.

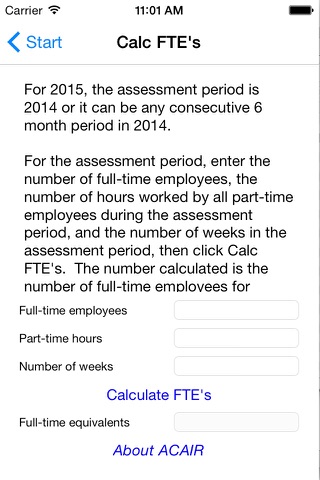

In addition, you will learn what a full-time employee is, how you determine if you are considered an applicable large employer (ALE), and what information needs to be collected and included on the various tax forms.